In this week’s post, I explain the basics of compound interest.

Compound interest is how reinvested interest (or any investment return) builds on itself – interest is earned on interest. Although this might not seem very exciting, compound interest is very powerful. This post will be the first in a series focusing on compound interest and how you can make it work in your favor.

Last week, we finished a series covering different types of investment accounts and investment securities. However, we did not fully address why investing is important to begin with. Compound interest is one reason why investing is important.

What is compound interest?

As mentioned above, compound interest is the phenomenon of how reinvested interest builds on itself – interest is earned on interest.

For example, Suzy opens an account with $1,000 and earns 10% interest each year. In the first year, she earns $100 in interest ($1,000 * 10%). However, if Suzy reinvests this interest, she will earn $110 in the second year ($1,100 * 10%) and $121 in the third year ($1,210 * 10%). The investment will grow exponentially (at a faster and faster rate).

However, the opposite also happens if you are paying interest. Unpaid interest on debt also builds on itself. This is why debt in general, but especially credit cards, can be so dangerous – interest accumulates on interest.

Example of compound interest

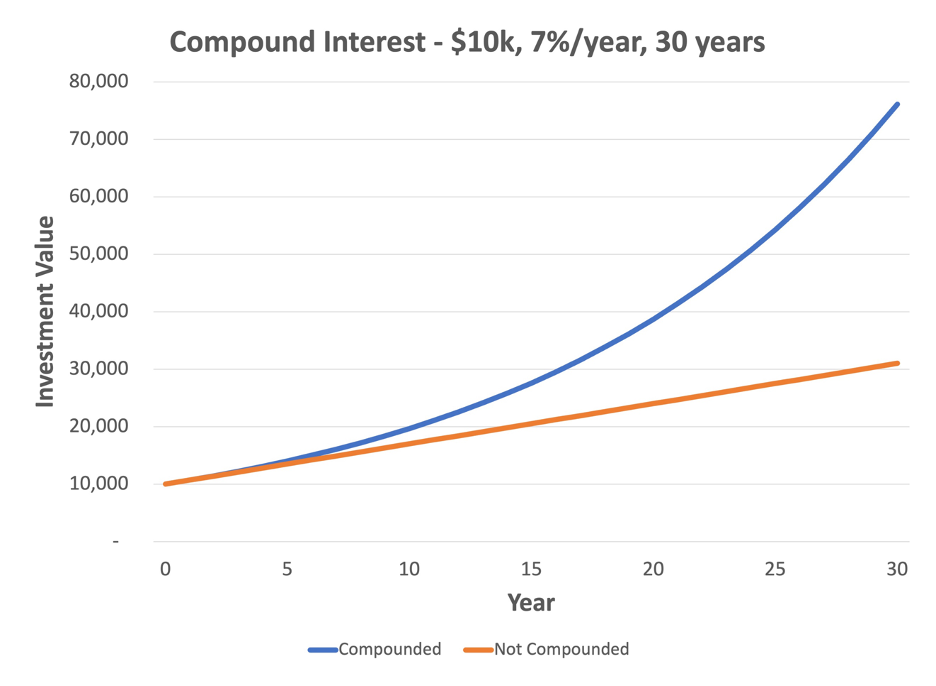

The power of compound interest is best displayed when contrasted with the same investment without compounding. For example, an account is funded with $10,000, earning 7% a year for 30 years. If the returns are compounded annually, the investment will grow to $76,123 at the end of 30 years. If the interest is not compounded (not reinvested), the account will only grow to $31,000 at the end of 30 years.

Here is a graph showing these two scenarios:

As you can see, the compounding account grows exponentially – much faster than the account without compounding.

Compounding is powerful and allows small investments to grow into large sums over time.

If you have any comments, questions, or ideas for future posts, please let me know

I hope you found this post helpful and educational. If you have any comments, questions, or ideas for future posts, please let me know. You can reach me directly via email at crawford@ulmerfinancial.com.

Comments